In order to understand if an MCA will really help your business in the long run, you should know what it is and how it affects your daily business.

Is it a loan?

First, it's important to know that a Merchant Cash Advance is NOT a loan.

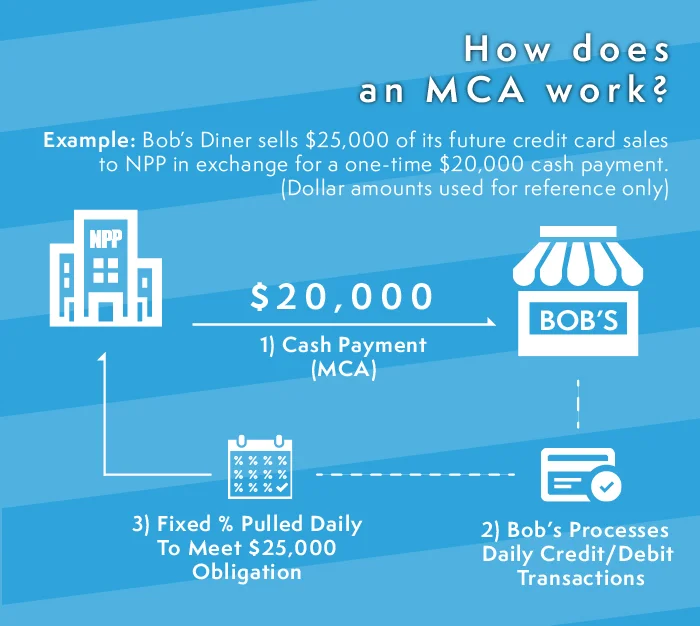

An MCA is a lump-sum payment to you in exchange for a small percentage of your business' future daily credit card income.

Therefore, it's a PURCHASE of a portion of your future credit card sales.

When you receive an MCA, you are essentially being paid in advance for a small percent of your daily credit card transactions. That small percentage will then be automatically remitted (or pulled) directly from your transaction totals until the total amount of your advance has been fulfilled.

You get your cash fast. You don't have to worry about due dates or penalties.

Want an example?

Here's a simple illustration of how an MCA works. Please note that dollar amounts in this example are just for easy reference.

Click here to get the full NPP MCA infographic.

How do I apply?

Remember, a Merchant Cash Advance is a PURCHASE of a portion of your future credit card sales.

Since an MCA is approved based on your business's sales, you will need to have at least a 3-4 month history of processing credit cards and proof in statements from NPP or another processor.

If you have at least 3-4 months of processing statements and a merchant account with NPP, it just takes a short application and a few days to process your Merchant Cash Advance!

If you have no history of processing credit cards, don't worry! Contact us at any time and we can help you set up a merchant account and get started towards receiving an MCA in the near future.

To learn about all of the benefits of an MCA, please view the article “Why Apply For A Merchant Cash Advance?”